which states have a renters tax credit

Funds from this program must be distributed by 2022. It offers a broader renters tax credit for tenants.

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

In many states the renters tax credit is limited to those over a certain age or with a disability.

. Which states have a renters tax credit. 87066 or less if you are marriedRDP filing jointly head of household or qualified widow er You or your spouseRDP were not given a property tax exemption during the tax year. A properly completed application means that all questions are.

Colorado offers a PTC Property TaxRentHeat Credit rebate of up to 976 for eligible renters. As far as I know the states that have anything for rent are Vermont Michigan MaineMaryland Massachusetts Minnesota Missouri New Jersey Rhode Island California Hawaii Indiana Iowa Arizona Wisconsin and. 11 States That Give Renters A Tax Credit Ad Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings.

Renters Tax Credit Application Form RTC 2022 The State of Maryland provides a direct check payment of up to 100000 a year for renters who paid rent in the State of Maryland and who meet certain eligibility requirements. The majority of states that offer renters tax credits have very specific income parameters. Many states offer renter tax credits or tax deductions.

Lived in the same New York residence for at least six months. To qualify for the rebate in 2022 you or your spouse must be over 65 years of age. Property owners may automatically qualify for their own refunds just based on owning.

The catch is that you must file a couple of special forms to request the refund if youre an Arizona senior renter. AB-1482 Tenant Protection Act of 2019. Additionally there are income limits of 21381for married couples filing jointly and 15831 for singles based on your earnings.

The deadline for filing an application is October 1 2022. North Dakota Homeowners Renters Could Qualify for Property Tax Credit or Renters Refund. A bill proposed by state Sen.

This program provided an additional 2155 billion to the pot. ERA 2 was created as part of the American Rescue Plan Act of 2021 and was enacted in March of 2021. 43533 or less if your filing status is single or marriedregistered domestic partner RDP filing separately.

This is a refund credit which means that you will receive a refund on your state income tax filing at the end of each year that you qualify. ERA 1 provided 25 billion dollars directly to the states and Indian Tribes to set up rental assistance programs. The state reimburses the counties for the full amount of credit allowed.

New Jersey allows the larger of a 20000 deduction. The requirements for this tax credit vary by state so its vital to get the details for the area you live in to see if you qualify. Check if you qualify.

If you have additional questions regarding the Renters Tax Credit please contact the Departments Renters Tax Credit Program at sd atrentersmarylandgov or 410-767-5915. As long as your building is your primary residence located in Indiana and subject to. Thats because these programs help ease the financial burden of low-income households.

2019-2020 Through 2030 rent increases are capped at 5 plus the increase in regional Consumer Price Index CPI or 10 of the lowest rent charged in the prior 12 months whichever is less. Statewide rent control caps city-specific laws. The majority of states that offer renters tax credits have very specific income parameters.

If you have additional questions regarding the Renters Tax Credit please contact the Departments Renters Tax Credit Program at sd atrentersmarylandgov or 410-767-5915. Indiana is the exception. Renters earning less than 43533 a year are eligible for a 60 tax credit and renters earning less than 87066 a year who are married and file taxes jointly are eligible for 120.

Steve Glazer D-Orinda would increase those credits to 500 for single filers and 1000 for both joint filers and single filers. Disabled residents also qualify.

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Homebuying Vs Renting A Cost Comparison 30 Year Mortgage Mortgage Payment Rent

Renters Insurance Is Cheaper Than You Think Infographic In 2020 Renters Insurance Tenant Insurance Insurance Marketing

11 States That Give Renters A Tax Credit

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

You May Be Able To Claim A Renter S Tax Credit If You Live In These States Apartmentguide Com

Renters Application Form Pdf Check More At Https Nationalgriefawarenessday Com 21676 Renters Application Form Pdf Rental Application Application Renter

Rent Receipt Free Printable Www Rc123 Com Free Receipt Template Receipt Template Being A Landlord

A Month To Month Rental Agreement Or Lease Agreement Is A Legally Binding Contract Rental Agreement Templates Lease Agreement Free Printable Lease Agreement

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

Average Rental Rates For A Three Bedroom Apartment In Dallas Tx Neighborhoods Apartment Rent Ren Moving To Los Angeles Los Angeles Apartments New Downtown

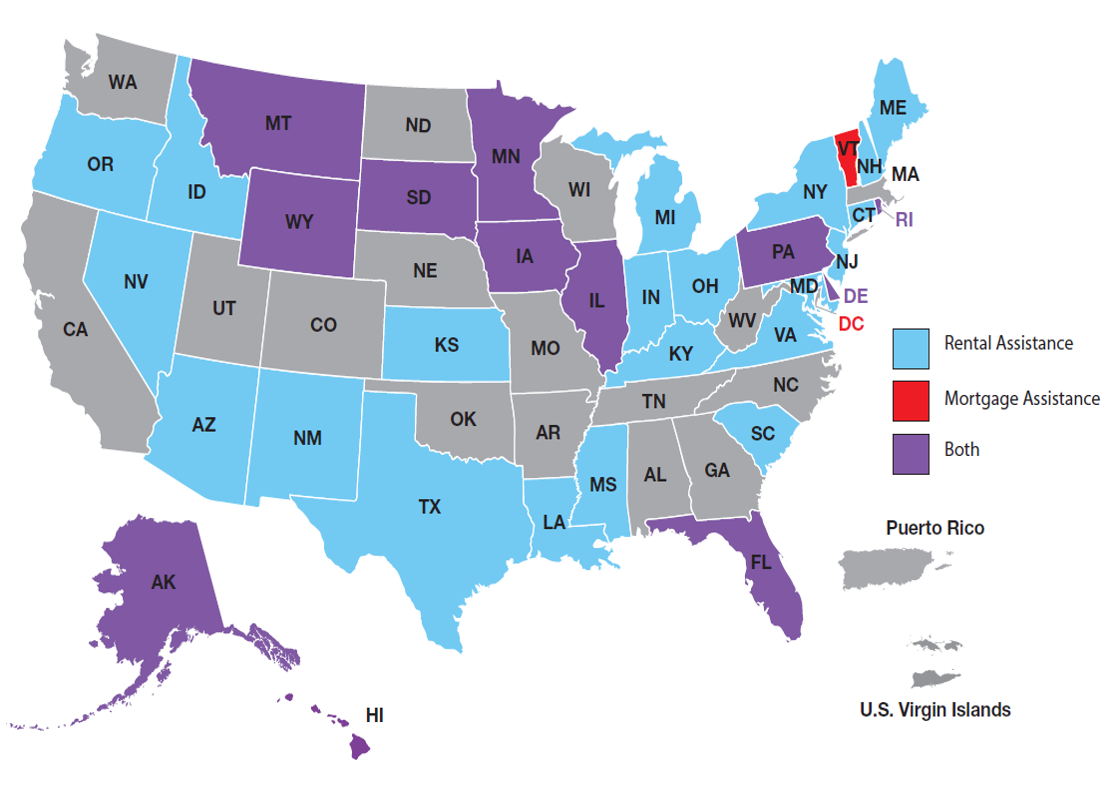

State Hfa Emergency Housing Assistance 2020 Programs Ncsha

Tax Benefits Of Buying A Home In Jackson Hole Wyoming Wyoming Home Buying Inheritance Tax

Minimum Wage Workers Cannot Afford Rent In Any U S State

Don T Miss Out On These Facts About The Form 8615 Turbotax In 2022 Turbotax Online Accounting Tax Brackets

Nearly 73 000 Affordable Rental Homes Over A Decade Could Be Financed With 30 Lihtc Rural Basis Boost Proposal Novogradac

Irs Schedule C Tax Deductions Expenses For Small Business Owners Debt Relief Debt Relief Programs Debt Collection Agency